us germany tax treaty summary

ECEDs or USCEDs business property of a. If you have problems opening the pdf document or viewing pages download.

Taxes On Stocks In Germany Everything You Need To Know

If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced.

. It is important that you read both the treaty and the protocols that. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax treaties and treaty.

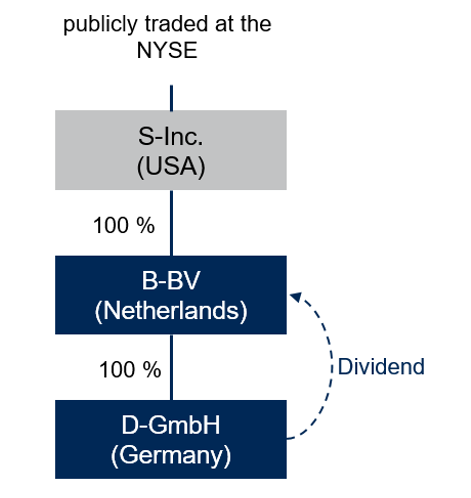

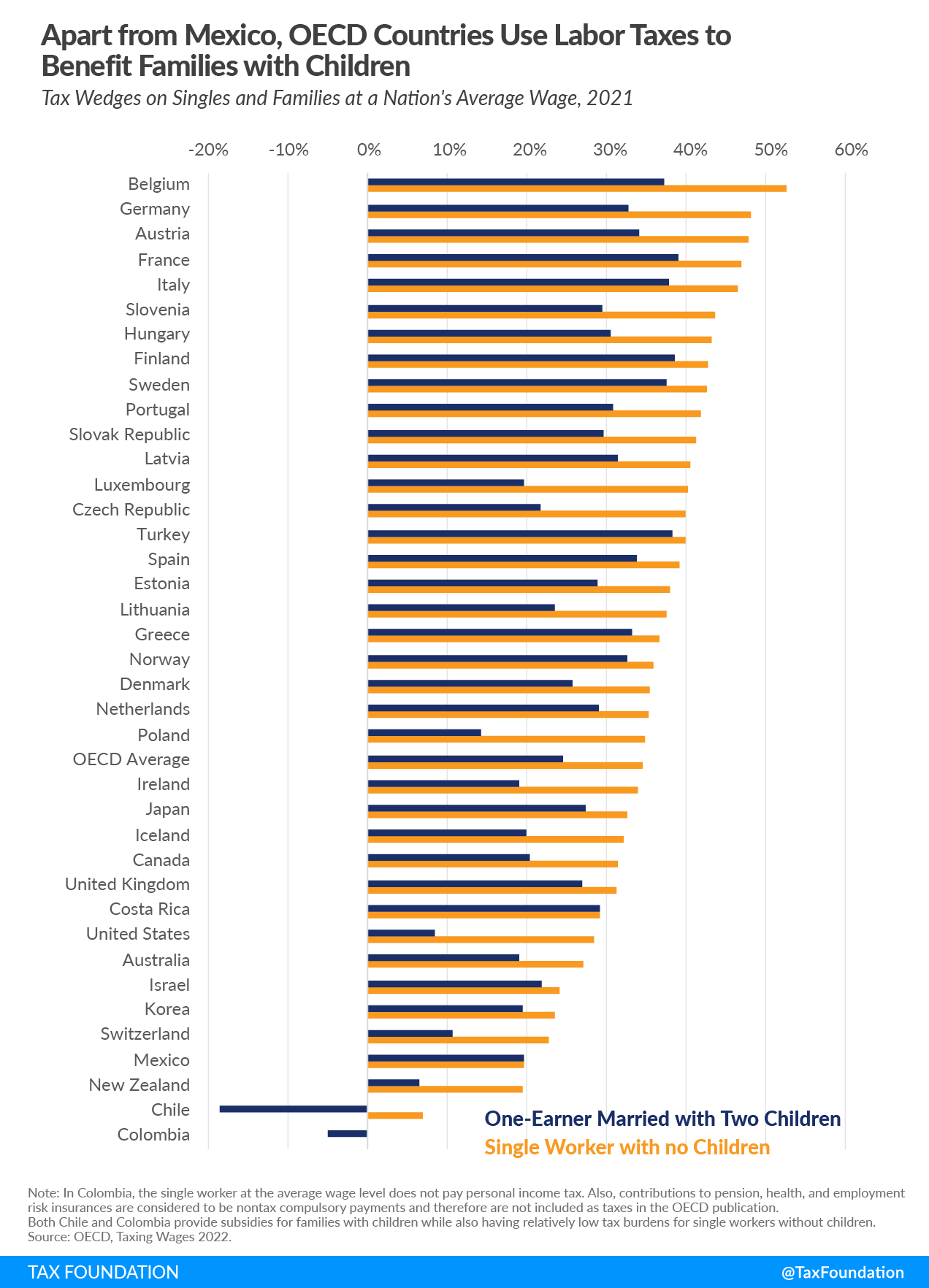

Alongside income tax there is also a. For purposes of the US-Germany tax treaty the municipal business tax is treated like an income tax. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the.

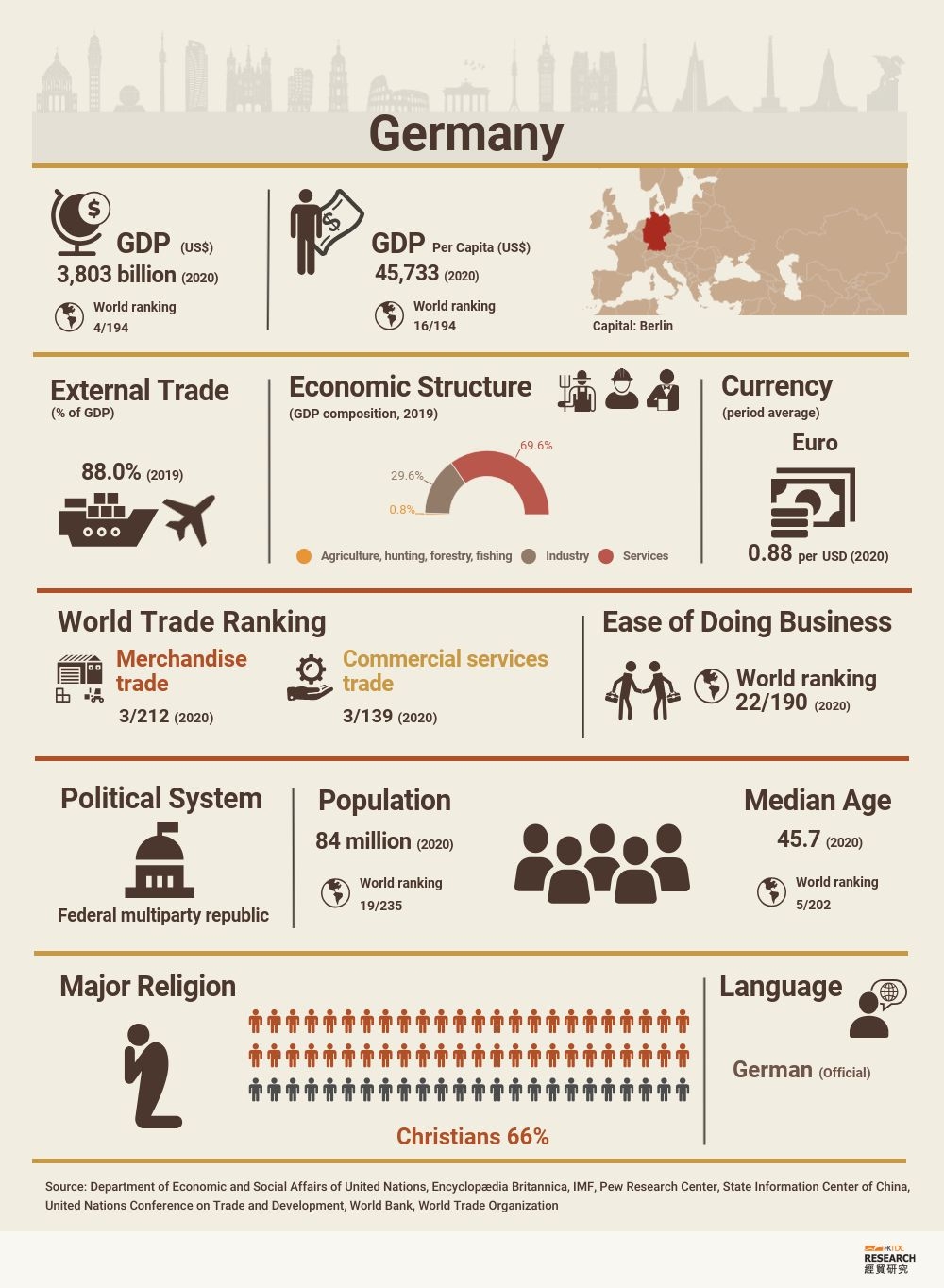

The United States reserves the right except as provided in paragraph 5 to tax its residents and citizens as provided in its internal law notwithstanding any provisions of the. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. The Effect of Tax Treaties.

If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in. German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country.

Germany and the United States have been engaged in treaty relations for many years. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990. The treaty has been updated and revised with the most recent version being 2006.

The complete texts of the following tax treaty documents are available in Adobe PDF format. The United States is a party to. The purpose of the Germany-USA double taxation treaty.

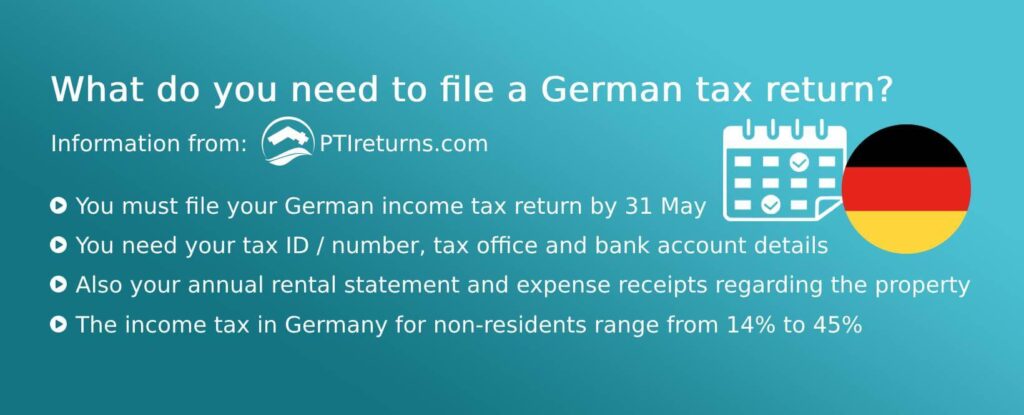

Convention between the United States of. German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit. If you are treated as a resident of a foreign country under a tax treaty and not treated as a.

Germany - Tax Treaty Documents. Germany also imposes estate tax on the US real property but gives ECEDs or USCEDs heirs or estate a credit against the US tax8 In addition. 61 rows Summary of US tax treaty benefits.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. A protocol is an amendment to a treaty. Residency for treaty purposes is determined by the applicable treaty.

If you have problems opening the pdf document. This table also shows the general effective date of each treaty and protocol. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

The purpose of the. Exemption on Your Tax Return.

Germany Market Profile Hktdc Research

United States Germany Income Tax Treaty Sf Tax Counsel

Germany Checks One Nato Box Leaves Another Open Germany News And In Depth Reporting From Berlin And Beyond Dw 08 04 2022

German Tax Advice For Smart Foreign Real Estate Investors Owners

Taxes On Stocks In Germany Everything You Need To Know

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Germany

Germany S Coalition Agreement Deloitte Legal Germany

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Germany Usa Double Taxation Treaty

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Income Tax In Germany For Foreigners Academics Com

Germany United States International Income Tax Treaty Explained

German Tax Laws Pushed Through Before End Of Current Parliamentary Term Verena Klosterkemper

Double Taxation Taxes On Income And Capital Federal Foreign Office

The Shortest History Of Germany Review Probing An Enigma At The Heart Of Europe History Books The Guardian

German Tax Advice For Smart Foreign Real Estate Investors Owners

Germany Tax Information Income Taxes In Germany Tax Foundation

What Is The U S Germany Income Tax Treaty Becker International Law